What Is an FHA Loan?

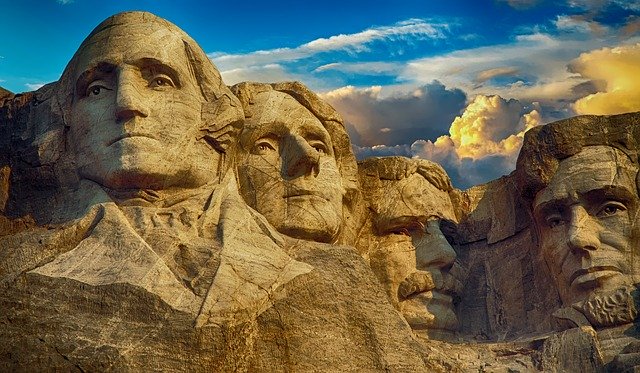

Owning your home is part of the American dream. Yet it’s often a struggle to afford the down payment and closing costs. The good news is that there are FHA loans available that can help you overcome these challenges, making homeownership a reality.

FHA Loans: Government Backed Mortgages

These loans are backed by the Federal Housing Administration, making homeownership accessible to borrowers that have difficulty getting approved for a conventional mortgage.

These loans are a viable financing option for individuals who lack a credit history, can only make a low down payment, or don’t have the cash to cover closing costs.

Key Facts on FHA Loans

While these loans help individuals own their homes, there are a number of eligibility requirements.

- FICO Score Requirements:

- 500-579: 10% down payment

- 580+: 3.5% down payment

- 2 years verifiable employment history

- Private Mortgage Insurance (PMI) required

- Upfront premium: 1.75% of loan amount

- Annual premium: 0.45-1.05% (depending on loan term)

- Must be used on primary residence

- Fixed terms: 15-years and 30-years

- Eligibility delayed after a bankruptcy or foreclosure (12-36 months)

While government-backed, these loans are issued by FHA-approved mortgage lenders. These lenders will ensure that you qualify, submit the loan for approval, and issue the loan.

Is It the Right Loan for You?

It’s true that these loans can help individuals own a home, but they aren’t the right option for all borrowers. A Mortgage Solutions Financial loan officer can help you determine if you qualify for one and if it is the right financing option for your situation. Contact us today to get started!